(Credit: Wikipedia)

The polling consensus these days is that most Americans support extending the Bush-era tax cuts just for the middle class and not for the very rich. The polls on this matter are considerably more consistent than they were when I first wrote about this subject last September. At that time, the reported percentages opposed to extending the tax cuts to the rich varied from a high of 66 percent to a low of 27 percent, suggesting that public opinion hadn’t really jelled at that time.

More recent polls (see pollingreport.com) show less variation, with the polls since the mid-term elections suggesting that either a significant majority, or at least a plurality, of Americans prefer the limited tax cuts to extending the tax cuts on all levels of income.

Nevertheless, all the pollsters – and the vast majority of journalists and politicians – continue to frame the issue incorrectly. The most recent poll on this matter, one conducted by CBS, illustrates the problem.

Nevertheless, all the pollsters – and the vast majority of journalists and politicians – continue to frame the issue incorrectly. The most recent poll on this matter, one conducted by CBS, illustrates the problem.

The question that CBS asked is as follows:

Which comes closest to your view about the tax cuts passed in 2001?

- The tax cuts should be continued for everyone (26%)

- The tax cuts should only continue for households earning less than $250,000 a year (53%), or

- The tax cuts should expire for everyone?(14%)

The problem with this wording is that option #2 is incorrect. If tax cuts are continued for incomes of less than $250,000, all households would benefit from those tax cuts – even those households where the total yearly income is higher. The households with higher incomes would still get the benefit of the tax cuts up to the $250,000 level, as would all other households, but they wouldn’t get tax cuts on their income above $250,000. Nobody would.

So, the major disagreement between the Republican and Democratic Parties is not whether the tax cuts should or should not be continued for everyone. Both parties agree that everyone should get an extension of the tax cuts – with Democrats wanting to limit the tax cuts to apply to incomes under $250,000, and Republicans wanting to allow the tax cuts to apply to all income levels.

This may seem like a minor distinction, but it can significantly influence how people see the issue – as one where one group is discriminated against (the “wealthy”), or as one where everyone is treated equally.

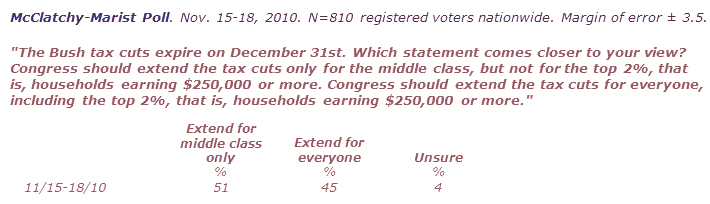

As it happens, pollsters are treating the issue as though one class of people, the wealthy, would suffer discrimination. For example, the post-election McClatchy-Marist poll was quite explicit: should the Bush-era tax cuts be extended only for the middle class or for everyone?

See above a screenshot detail of McClatchy-Marist’s poll on Bush tax cuts. (Credit: pollingreport.com) |

This poll did not examine how many of its respondents wanted to let all the tax cuts expire, and thus obtained a much larger percentage of people choosing the second option offered (in this case: extending the tax cuts “for everyone”) than do other polls.

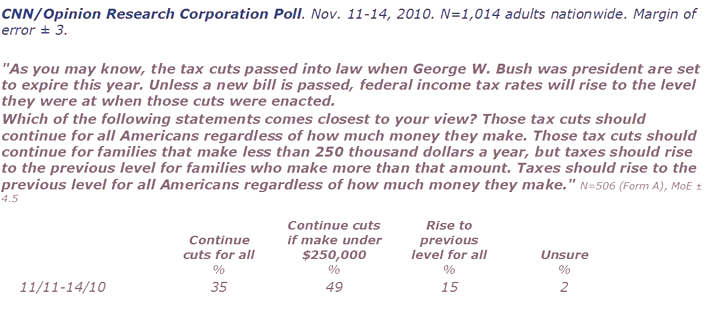

A CNN poll only a few days earlier also presented the issue as though the “wealthy” would get no benefits.

See above a screenshot detail from CNN/ORC’s latest poll on the tax cuts. (Credit: pollingreport.com) |

The above question, similar to the questions asked in the other polls, provides incorrect information to the respondents and cannot help but obtain imprecise measurements of public opinion.

In fact, CBS shows a 27-point margin in favor of tax cuts for households earning under $250,000 over tax cuts for everyone, while CNN shows a 14-point margin and McClatchey-Marist just a 6-point margin.

There are many reasons why these polls come up with wildly different results, but they all relate to bad question wording – a “forced-choice” format, no measure of intensity, and – as shown in this article – simply mischaracterizing the issue in the first place.

David W. Moore is a Senior Fellow with the Carsey Institute at the University of New Hampshire. He is a former Vice President of the Gallup Organization and was a senior editor with the Gallup Poll for thirteen years. He is author of The Opinion Makers: An Insider Exposes the Truth Behind the Polls (Beacon, 2008; trade paperback edition, 2009). Publishers’ Weekly refers to it as a “succinct and damning critique…Keen and witty throughout.”

Comments Terms and Conditions