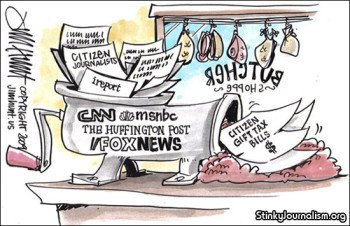

Citizen journalists provide content to for-profit media outlets without getting paid. It turns out since content has value, IRS rules may consider this transaction "a gift." This is bad news for citizen journalists who may be subject to unexpected gift tax, while media companies don't owe a dime.

EXCLUSIVE: Mainstream Media (MsM) have lately been hanging their hopes on armies of citizen journalists who are willingly providing them with free content. These for-profit media enterprises, which include CNN iReport, The Huffington Post, FOX uReports and MSNBC First Person, benefit financially from the original work of “volunteers” who “donate” their intellectual properties—videos, articles, commentaries and images—for no pay. This is, literally, something for nothing to these profit-seeking enterprises, a financial windfall that pads their own bottom lines at virtually no risk. While the “volunteers” have their own personal reasons for giving their work away—everything from raising their own profiles or exposing corruption and criminality to pure altruism—they may be unknowingly stepping into a tax minefield. Indeed, according to the rules of the Internal Revenue Service, this popular cost-slashing strategy—the business model for which is based on transfers of content (intellectual property) from citizen journalists to media outlets at no fee—may subject the contributors to a gift tax.

With this in mind, iMediaEthics has asked the question: Is the “donation” of a citizen’s content (video, articles, commentaries, images) to for-profit media outlets that exceeds a fair market value of $12,000 in any single year subject to gift tax? Judging from the IRS guidelines, the answer is “yes.”

The IRS defines gifts on its web site: “You make a gift if you give property (including money), or the use of or income from property, without expecting to receive something of at least equal value in return.” Thus, when citizen journalists give content to media outlets, they are making a gift. Surprise! Most people do not realize that donors, not recipients, pay gift taxes.

This possible tax minefield also came as a surprise to many media experts. When imediaethics.org approached David Ardia, the director of Harvard University’s Citizen Media Law Project, with this unspoken and often unrecognized peril for citizen journalists, he responded, “I think this would come as a surprise to most people who consider themselves citizen journalists. They have very little idea of legal issues around the work they are doing and even less knowledge about the tax implications around what they’re doing…It is an area yet to be investigated.”

The founder and president of the Media Bloggers Association, a nonpartisan non-profit organization that promotes citizen journalism, Robert Cox, agrees. “This is a real earthquake into the financial model. [This] would certainly have an impact on Huffington Post and a few others…that get content that they don’t pay for. It is a real issue. Nobody has thought about it at all.”

Nikhil Moro chairs the Civic and Citizen Journalism Interest Group, which is part of a national association of journalism scholars. His group focuses on participatory journalism. Dr. Moro, an authority in media law who teaches at Central Michigan University, said, “I think it’s a very important investigation that you are doing.”

Dr. Moro agreed with Mr. Cox. “How our tax laws treat citizen journalists, particularly the non-professional, non-traditional online publishers, is an area that is in desperate need of examination,” he said.

“Any tax on citizen journalists for their contributions goes right to the heart of the First Amendment. It should raise our collective hackles. Discriminatory taxation has historically been a tool for government to impose prior restraint,” Dr. Moro said, adding, “In the last couple of decades, corporations have in some ways assumed government’s historical role as a primary threat to free speech.”

The bottom line: iMediaEthics has uncovered a real hornet’s nest for both for-profit media companies’ business models and citizen journalists who must now examine how much work they have “donated” to any one media outlet over the past year. You should ask your accountant for help. You may even need to go to the expense of hiring a professional copyrights appraiser to help you declare what is called the fair market value (FMV) of your donations, as required by the IRS, and to file a 709 gift tax form. Your professional tax advisors may even suggest that you go back retrospectively for several years to consider re-filing taxes and sending in 709 forms for previous years, if the values seem like they would exceed the previous years’ $12,000 annual excemptions.

Aren’t you glad now that you fought your way to the top as a CNN “SuperStar iReporter” with your high-traffic videos? Aren’t you pleased to be a celebrity who helped out your BFF Adrianna Huffington by writing lots of snarky articles during the last hot political year?

If you donate cash to the Red Cross—a real charity and not-for-profit enterprise—instead of donating content to for-profit media companies, such as CNN, FOX News and MSNBC or fashionable high-traffic sites like The Huffington Post, the rules are clear. You can get a tax deduction instead of a potential gift tax bill.

The inherent unfairness in this dichotomy shocked Leonard Witt, a communications professor at Kennesaw State University, who, like the other experts previously mentioned, is an advocate for citizen journalism. He also did not think of the potential tax consequences for citizen journalists (cum accidental philanthropists) when donating their intellectual property to profit-seeking business ventures. “It sounds just bizarre. And I don’t get it. How can this be? If you are right, this is a really important investigation,” he said.

Not to panic. Even if the fair market value of your “donation” to Huffington Post did exceed the $12,000 IRS limit for gifts to a single party in a single year, you will unlikely have to cough up cash. Again talk to your accountant, but everyone has a lifetime allowance for gift giving that is factored into his estate. During your lifetime, you are allowed to give, as of 2008, $1,000,000 (technically called the applicable exclusion amount, formerly known as unified credit; see IRS Publications 950 and below for explanation). This is different from estate tax, as the applicable exclusion for estate taxes is, as of 2008, $2,000,000. Every year that you exceed the $12,000 limit with any party, the amount that goes over the $12,000—whether in cash or appraised goods (intellectual property)—must be submitted on your 709 form. That annual number is tracked and the total amount is applied against your lifetime allowance. If the total exceeds $1,000.000 during your lifetime, you owe gift tax on the excess amount (for example, $1,100,000 in gifts creates an excess of $100,000). The first $345,800 in gift tax owed is credited back to you (never collected), because that is how much gift tax would be owed on $1,000,000 (when calculating with the IRS’s incremental rate. See chart on page 12 of IRS instructions for form 709). To clarify, once you know how much you owe in taxes, you subtract that number from $345,800. When the $345,800 runs out, you will owe taxes each time you exceed the $12,000 annual exclusion. You may want to reread this information (we had to! But we also asked Denise Hayner, CPA, to check our numbers just to make sure.)

For example, a fair market value (FMV) appraisal of a hypothetical “Joe Blow’s work” determined that he donated in 2008 a whopping $347,000 of goods and would be taxed $103,780. Poor Joe. See Chart.

|

||||||||||||||||||||||||||||||||||||

*In this scenario, CNN or FOX News sold licenses to other media outlets throughout the world and earned in year one $100,000. The hypothetical fair market value appraisal of $350,000, was based upon multiple possible years of future earning (5 years) that, even with depreciation, greatly enhanced the value of the gift to CNN or FOX and correspondingly, the gift taxes. More comments on this point found later in this article.

**Amount of tax due was calculated per IRS tables: $70,800+34% of ($347,000-$250,000) which equals $103,780.

The amount of tax applied against your applicable exclusion amount is $103,780. That leaves you with $242,020 remaining for subsequent years. Most people won’t use up their lifetime allowance but some will. In any case, you have to do the appraisal to make sure you have not exceeded the $12,000 annual limit and to file the 709 form for gift tax tracking the total over your lifetime.

Joe Blow’s heirs, when reviewing his estate, would see a list of gifts given over his lifetime. Instead of just children and grandchildren, in the topsy-turvy world born of this new business model, commercial exploitation of free gifts of often valuable intellectual properties donated by citizen journalists, would also include the names of FOX News, CNN, MSNBC and Huffington Post alongside the names of the grandchildren. After all, the media have been crying poverty of late and firing journalists galore in cutbacks. Maybe this new business model is, in effect, a citizen journalist bailout for media companies. Just as it was when the federal government bailed out profit-seeking companies, citizens are the ones who end up unexpectedly paying for profit-seeking–but failing– corporate America.

| Do You Owe IRS Gift Tax?

-Annual gift is limited to $12,000 per media outlet. Any amount greater is subject to gift tax. -The responsibility of paying gift tax lies solely with the donor. -You must determine FMV of your gift, (i.e. content: video, images and articles).* -Any FMV above $12,000 is subject to up to a 45% gift tax (see IRS chart, page 12). -If your gift exceeds $12,000, you must file form number 709 -You must also track annual gifts and apply the amount in excess of $12,000 per individual toward the lifetime allowance for your estate -Gift tax does not apply to gifts given to a spouse, political organization or charity; or to gifts valued at less than $12,000 (for 2008, $13,000 in 2009). -The content donated by citizen journalists seems to qualify as gifts under IRS rules as they were given “without expecting to receive something of at least equal value in return.” Receiving services in exchange for other goods (like articles or other intellectual property) would be considered a “barter” by the IRS and require FMV determination of both sides of the trade. Tax would be owed unless both valuations were the same—which they, in all likelihood, would not be. (More on this situation and barters in general, in Part II of our series). -You should seek professional tax advice and intellectual property appraisals. |

The Nonsense Makes Sense—just follow the money…and the IRS rules

The precise process for determining the fair market value of intellectual property has always been difficult–and often expensive–to determine and later defend. In the new industry of “charitable-minded” citizen journalists who donate their works to media companies, this will most likely follow the traditional approach of tax professionals. They are routinely asked to determine values of intellectual property and copyrights as part of estate work. iMediaEthics spoke with Paul Engel and Larry Goldberg, managing directors of Appraisal Economics Inc, about the process of determining value. The new Jersey-based firm has 25 appraisers, most of whom are certified, and has been appraising property for 20 years.

“We’ve done a lot of that for authors and all sorts of intellectual property,” they said, “It is routine, although each one has its own nuances and difficulties.” Indeed, the complexities can lead to considerable expense. Ron Stramberg is managing director of the national valuation and appraisal firm Klaris, Thomson & Schroeder, Inc. The firm has been assessing the value of intellectual property for fifteen years with 6 offices across the country. He says the fee for a well organized citizen journalist, with complete record keeping, could likely have their content appraised for a fee “in the neighborhood of $2,000-3,000.” Both Engel and Stramberg believe the price would drop as demand increases. “The fees could drop easily below $1,000,” Engel said. Citizen journalists need to seek out intellectual property appraisers to find out more about determining the value of their work.

The challenge is similar to that of appraising any intellectual material – articles, books, artwork, music and more. These are all assets of varying fair market worth whose value must be determined, as difficult as this sometimes is. Intellectual property and copyright appraisals that carried out by certified experts, that can easily cost thousands of dollars. This is a possible cost the citizen journalist must plan for as part of their content donations, in addition to possibly filing a 709 form with the IRS. We have thought of many criteria that can help you and your professional appraisers determine the value of your work. Stramberg agreed with our criteria. “In these circumstances you would look at a couple different approaches to value this video asset,” he said. “One approach would be looking at the future income that would be derived from a sale of the asset and an alternative would be looking at the costs that would be saved by the network by not having to produce the video and using it instead. A third manner in which we would value the asset or consider valuing the asset would be the accumulated costs.” See chart below.

| How to think about FMV-

–IRS Definition of FMV– ” Fair Market Value is defined as: “The fair market value is the price at which the property would change hands between a willing buyer and a willing seller, neither being under any compulsion to buy or to sell and both having reasonable knowledge of relevant facts.” -Consider freelance rates—What does the industry pay you or others for similar content? -Think about fees you received for equivalent work (i.e. the New York Times pays $2,500.00 for op ed pieces and you gave 15 equivalent articles to The Huffington Post in 2008.) -Time spent producing content (You spent 6 months producing content for The Huffington Post. How can 6 months of work be worth only $12,000?) -Consider costs (How much did it cost to produce? What would equal work cost the media company?) -Visitors and ad sales (How many hits or unique visitors did your content generate for the media company?) -License income generated (How much did CNN earn selling your iReport to another media outlet? How many possible years in the future will the video have sales?) -Consider hiring an appraiser familiar with valuing intellectual property and copyrights. |

The Jig is Up: No More Quantum Magic Accounting –Intellectual Property cannot have both value and no value at the same time.

The first criterion is to look at fees paid to the citizen journalist by organizations who pay them in comparison to those who don’t, like the Huffington Post. The Huffington Post is a news site (“The Internet Newspaper”) with approximately 8 million visitors a month. Though it has some paid staff to write some original news articles, it mostly relies on unpaid—and mostly high-profile—bloggers to drive traffic. The bloggers are not all private citizens blogging in their free time. Take a look at the list of Huffington Post bloggers and you will recognize names: Alec Baldwin, Star Jones, Larry David, Neil Young, Harry Shearer, Desmond Tutu. Such celebrities are paid large sums of money for appearances and commentary in other publications. So just because they decide to give their pal Arianna Huffington 10 opinion pieces a year, doesn’t suddenly make these valuable articles’ asset value suddenly disappear.

Robert Cox said, “It sounds like it is a nightmare for the Huffington Post because they are getting all of this unrecognized value in the form of free content and individual bloggers may [or may not] add up to any particular threshold. Many bloggers may argue that they are not at $12,000, but certainly the HuffPost has received at least that much a day. Certainly more than zero.”

Huff Post has been roundly criticized for not paying for content. Steven T. Jones and Tim Redmond, San Francisco Bay Guardian, reported that: “HuffPo is still struggling to find a business model that allows it to expand its original reporting and pay journalists a living wage, a problem highlighted recently by a controversy about HuffPo stealing content without permission…As for the larger issue of not paying for content, she [Arianna Huffington] makes a distinction between journalism and blogging, citing the mantra, ‘Facts are sacred, opinion is free.’ That means HuffPo bloggers benefit from a large audience for their work and from a team of moderators who filter out the flames and personal attacks that constitute so much of the online commenting. But they don’t get paid.”

Professional journalists are also among those who are not paid staffers but provide free content, such as Charles Karel Bouley, who writes under the byline “Karel.” According to his Huff Post profile, Bouley has the #1 talk show in his time slot at ABC’s flagship station, KGO AM 810 San Francisco (#1 overall station). He is also a columnist and does film and television reports for various stations. A Star Jones article is ranked 5th “all time” most viewed on the Huff Post site with an astonishing 572,618. Larry David’s posting placed 6th in the top post bloggers index with 565,551 views. The number one all time most viewed article in Huff Post history is by Charlotte Hilton Anderson with an incredible 995,989. Ka-ching!

Anderson’s Huff Post bio says: “Charlotte runs the popular health and fitness site The Great Fitness Experiment. She was featured on ABC’s 20/20 and interviewed on FOX’s Morning Show with Mike & Juliette. Her writing can be found on the Washington Post online, FOX News online, LiveStrong, and iVillage as well as many other health, fitness and body image sites.”

Anderson or the other Huff Post celebs don’t have to know the value of their articles before posting. Valuation of the articles “gifted” would be done at the end of the tax year. The “Top Posts/Blogger Index” makes it easy for your appraiser, or the IRS for that matter, to gather information about your postings – “most viewed, most commented, most emailed, most fans.” All these criteria offer possible indicators of value. (Think about it: if Larry David sells five articles as a professional writer for a tidy sum in one calendar year, but gives another three away to Huff Post, on what FMV basis would the five articles command high fees, but the other three of similar length are worth nothing?)

Do The Huffington Post’s accountants really believe the intellectual property of Larry David, Star Jones, Charles Karel Bouley or Charlotte Hilton Anderson has zero value? Huff Post may call these stars “bloggers” but they are more like featured columnists that draw huge visitor traffic.

Ask yourself: How can a web site like Huffington Post be worth millions to investors and at the same time all of its donated content be worth zero on an individual basis? An accounting game that seems to be afoot here gives asset value to the citizen journalists’ content only after the media owns and controls it and can even earn income licensing it to other media outlets. How convenient.

Now add on top of this the fact that it is the citizen journalists who have the burden of obtaining FMV appraisals, the expense of filing 709s and finally paying possible gift taxes that can only be sheltered by reducing the lifetime gift allowance used to create tax-free wealth for their heirs. Nice. By “donating” or “gifting” just a handful of opinions pieces to The Huffington Post, based upon information and belief, celebrities are possibly well beyond the allowable $12,000 gift for any one calendar year, even with only a handful of posts. This means they will need to file 709s, past present and future. Of course, this article does not presume to offer tax advice. Celebrities must consult their tax professionals…just like the rest of citizen journalists making contributions to for-profit media sites.

While not all citizen journalists are celebrities, many are producing reports, videos and photographs that are viewed around the world. For profit-seeking media companies, it’s literally the gift that keeps on giving. As the number of hits any individual content generates increases, so does the ad revenue and the overall asset value of the media web site. The amount of visitor traffic the content generates is a direct measure of the site’s asset worth to investors. Web sites themselves are appraised as part of due diligence for investors that accesses the aggregate asset value of all the articles and videos. Hence, the site value is directly dependent on the donated content value when that is the business model employed.

The quantity of citizen reports also helps determine value. CNN claims to have a database of more than 225,000 iReports. How much would it cost the company to produce 225,000 stories? Even if an iReporter donates 3 stories a year, depending on the success of the video and the production costs, the FMV could be higher than $12,000, the IRS limit. In fact, many iReporters are not “Joe The Plumbers” but successful, paid media professionals who likely deduct the expenses they incurred from creating their iReport. Unpaid content by iReporters is likely replacing the same on-air minutes that paid CNN employees filled before.

It’s one thing to sell your video or post your video on a free use (e.g., YouTube) or a not-for-profit web site like OneWorld TV or Internews. You continue to control your property as a real blogger or YouTube account holder, and can delete or hide it at will. (Try deleting your post that has 400,000 views on Huff Post as a Huffington Post “blogger” and see how far it gets you.) It is quite another to give your intellectual property (think breaking news video or photos), to those media companies who are using your gift to enrich themselves.

Dr. Moro, a PhD in media law, got to the heart of the issue. Media organizations such as CNN and the New York Times cannot on the one hand assert copyright and on the other hand deny commercial benefits to their citizen contributors’ intellectual property. Dr. Moro stated, “A key issue here is whether, in appraising the digital content typically produced by citizen journalists, we are going to appraise differently for the purpose of copyright than we are for the purpose of tax enforcement…any appraisal [for gift tax] should not differ from the value of the copyright [enforcement].”

Since copyrighted materials such as articles and videos have inherent and marketplace value–are bought and sold, require investment, generate production costs that can be tax deductible, defended as valuable in copyright violation cases and are often appraised as assets in estates (all taxable events as judged by the IRS rules)—it would only be sleight-of-hand or a new ruling from the IRS that would make the transfer of ownership of content from the citizen journalist donor to the for-profit media company not a taxable event.

(Geek Thought Experiment : Can intellectual property (IP) be subject to quantum effects? In other words, be like Schrodinger’s cat and simultaneously occupy two opposite states at the same time until the observer opens the box. Indeed, in the case of citizen journalism in a quantum universe, IP could have value and no value at the same time but only before the observer opens the box!)

Being a FOX News uReporter or MSNBC First Person Reporter is a bummer compared to being a CNN News SuperStar iReporter

Unlike the “terms of use” contract for CNN iReporters, FOX News uReporters must agree to fully transfer ownership of any photo or video that is uploaded to FOX News. See Text Box. Instead of becoming a “Superstar” featuring your name, FOX News terms state that they have to right to use your name or not. Worse, the terms are written where they can say they created YOUR photo or video works! (“Hello out there citizen journalists. Are you reading the fine print? Why would anyone agree to these terribly one-sided terms?!”) iMediaEthics asked FOX News about this, and a representative said the issue of changing their terms of use, like possibly paying a percentage of earnings like CNN iReport or changing the onerous term that they can use the content without attribution to the creator is under consideration in their legal department.

Hey Citizen Journalists: Watch Out for the fine printRip Off Alert : FOX News uReporter’s “Terms of Use” (emphasis mine) Unlike CNN iReporter—there is no provision cited to get paid when they re-sell your work.“If you upload or transmit Content, you grant to FOX a non-exclusive, royalty-free, perpetual, irrevocable, sub-licensable right to use, reproduce, modify, publish, translate, create derivative works (including products) from, distribute, and display such Content, in whole or in part, throughout the world in all media. You grant to FOX the right to use the name that you submit in connection with such Content. “You agree that any Content that you submit shall be considered non-proprietary and non-confidential. FOX shall have no obligations of any kind with respect to any Content and shall be free to reproduce, use, disclose and/or distribute any Content for any purpose whatsoever, without limitation. You also agree that FOX shall be free to use any ideas, concepts or techniques embodied in the Content for any purpose whatsoever, including, but not limited to, producing, developing and marketing news stories, shows, content of any kind, products or services incorporating such ideas, concepts, or techniques, without attribution.” MSNBC First Person is not much better than FOX uReporter: “By posting messages, uploading files, inputting data, or engaging in any other form of communication through this service, you are granting MSNBC a royalty-free, perpetual, non-exclusive, unrestricted, worldwide license to: Use, copy, sublicense, adapt, transmit, publicly perform or display any such communication. Sublicense to third parties the unrestricted right to exercise any of the foregoing rights granted with respect to the communication. The foregoing grants shall include the right to exploit any proprietary rights in such communication, including but not limited to rights under copyright, trademark, servicemark or patent laws under any relevant jurisdiction.” (The bottom line is that there’s still no money paid. It doesn’t mention “without attribution” but the contract may be interpreted to allow it. Watch out! ) |

CNN News iReporter has the best terms among the three broadcast citizen journalists programs

The CNN iReporters’ donated content has obvious value to Time Warner and its property, CNN. CNN cherry-picks the best reports and, for no cost, runs them on the web or on their citizen journalist content television and news programs such as “Anderson Cooper 360” and “News To Me.” The disclosure, cum contract, seen upon citizens uploading content states that if CNN resells your video, for example, then you will be paid a fee. Otherwise, citizens post their videos and stories for no payment.

In the MSNBC First Person or FOX News uReport there are no fees for citizen journalists. CNN iReport is the only one of the three that cites in their terms and conditions that if they license (meaning sell use of your video or photo) to other media outlets they will pay you a percentage. The amount of the percentage to you is not posted. But we called to ask and was told they pay iReporters 50% of the earned income.

The CNN iReporter contract states: “Notwithstanding the foregoing, in the event CNN licenses your material as stand-alone content outside of CNN’s programming to third parties unaffiliated with CNN, CNN will pay you a percentage of the license fees it actually receives according to rates determined by CNN’s licensing division, ImageSource.” In other words, a “donation” to CNN iReports converts to a fee-based arrangement upon expanded or distributed use of citizen’s content at the will of CNN. CNN apparently treats this as a taxable event only after the selection for distribution of the “shared content”–even though the content (videos, articles and photos) has value before this change in status.

Furthermore, the terms of use of CNN, MSNBC and FOX News all contain language that fiercely protects their material (formerly yours and other citizen journalists’ content) that is copyrighted and controlled by them for their benefit. For example, CNN states: “iReport.com owns a copyright in the selection, coordination, arrangement and enhancement of such content, as well as in the content original to it. You may not modify, publish, transmit, license, participate in the transfer, licensing or sale, create derivative works, or in any way exploit any of the content, copyrights, trademarks, or other property interests therein, in whole or in part.”

However, in all cases—MSNBC,CNN and FOX News—if your content is later distributed around the world to other media for their enrichment, your donation suddenly has a measurable asset value and you as the donor are subjected to paying possible gift tax.

In the case of CNN iReports, where you could possibly earn a percentage of the larger earnings CNN generates, you would pay taxes on the earned income but the asset’s value itself is separate. As discussed earlier, an appraiser would look at the long-term potential earning of the video or photo over a period of future years. The amount of income from distribution and broadcast from CNN, FOX News or MSNBC and rebroadcast from other media may be used to help predict future income and to appraise the value of the asset (in this case a video or photo) and thereby used to determine the amount of gift tax owed by the citizen journalist.

Let’s look at an example of what a citizen journalist could owe for one video donated to CNN. If CNN sells a video for worldwide distribution, it pays the original contributor 50% of the resale price. Say CNN earns $100,000 in the year you donated the video from licensing. The contributor is paid $50,000. Since the video can, over time, generate income, an appraisal needs to be done to estimate how much future income over how many years. It could be appraised at $450,000, for example. In this scenario, despite only receiving $50,000, the donor is exposed to a huge gift tax after the $12,000 exclusion. The gift tax is incremental (the top tax rate is 45%), but in this instance it is 34%. Do the math: $450,000 minus $12,000 exclusion equals $438,000. The citizen journalist in this scenario owes the IRS $134,720 in gift tax. This is deducted from the donor’s lifetime allowance along with monies to children and grandchildren. (Just start hoping that your grandmother or Uncle Joe keep their CNN iReporter Superstar donations to under $12,000 per year!)

So, how much does the citizen journalist owe?

Upon determining the value of the gift, citizen journalists will have to file IRS form 709 with their tax return. Gift tax is collected when an individual gifts more than $12,000 over the course of a year to an individual recipient (in this case, the media outlet). The first $12,000 worth of material to each organization is tax free. The tax is incremental, ranging from 18% when the gift is $1-$9,999 beyond the limit and capping out at 45% when the gift is $1,500,000 or more past the limit.

Thankfully, there are exemptions from gift tax. Gift tax does not apply to gifts given to a spouse, political organization or charity; or to gifts valued at less than $12,000 (for 2008, $13,000 in 2009). The only way these exemptions apply to a citizen journalist is if he is writing for a publication he or his spouse owns, for a political organization or a charity. CNN, FOX, MSNBC and Huffington Post would not fall into any of these categories. The responsibility of paying any gift tax lies solely with the donor. The recipient bears no responsibility whatsoever. So the media outlets that earn profit from these gifts do not owe taxes. They are only responsible for paying taxes on the income the gift generated.

The content provided by citizen journalists qualifies as a gift unless they earn payment or other services in exchange for their contribution. In that case, the exchange is considered a barter and taxable under other codes, with the responsibility falling on both parties–including both parties (citizen journalist and media company) getting fair market appraisals on their goods or services being traded. (More about tax implications of barter transactions forthcoming in Part II of our report.) Again the principle stated by the IRS is clear: “You make a gift if you give property (including money), or the use of or income from property, without expecting to receive something of at least equal value in return. If you sell something at less than its full value or if you make an interest-free or reduced-interest loan, you may be making a gift.”

Once it is established that the content is in fact a gift, not part of a barter deal or sale, the value of the gift must be determined. If the appraised value exceeds the annual $12,000 limit, taxes are due.

Conclusions

The proverbial wolf seems to have found a way into the citizen journalism hen house. As is the case with many things that start out as a public service, major corporations are sweeping in and finding ways to make a buck off what was once a citizen project—for citizens by citizens. The reality is when citizen journalists produce free content for for-profit media outlets, they can be making a gift to these outlets. Under U.S. tax law, any gift in excess of $12,000 per tax year given to one recipient is taxable. It is an incremental tax, ranging from 18% to 45% based on the amount in excess of $12,000, with the donor solely responsible for payment. The recipient bears no responsibility.

Thus, as things now stand, citizen journalists are likely accruing yet to be declared tax obligations by “gifting” content to for-profit media outlets. While the media enrich themselves after providing little or no compensation to donors, these companies are also failing to inform consumers (the citizen journalists) of the potential financial repercussions—in the form of tax due and owing—that citizens are developing.

| Can IRS Use Google to Audit You?

-A quick Google search or search of Huffington Post, for example, reports how many articles you write each year. -With a simple word count, the IRS can know how many articles with how many words you “donated” to media outlets. -Web statistics, available to anyone, will show IRS the number of visitors and hits of the site where you donated your work and your content pages. |

If the media outlets that rely heavily on citizen journalism wish to continue accepting gifts from citizen journalists—a practice that allows them to justify cutting their paid staff—they should, at a minimum, disclose this unspoken peril to their contributors in their terms and conditions.

CNN iReports are featured on “Anderson Cooper 360”, “News To Me” and other programs. Free content from citizen journalists means a stronger bottom line for this public company. |

imediaethics.org has contacted MSNBC, CNN, The Huffington Post and FOX News asking for comment and to request that a proper disclosure be made for citizen journalists that they may be subjected to gift tax. We asked: “Do you plan to immediately add a disclosure to the uReporter terms of use form (filled out upon any donation) that reveals to consumers (aka donors) that the annual aggregate of gifts given to FOX News, if they exceed $12,000 fair market value, would require filing a 709 Form to the IRS and that determination of fair market value may require a professional appraiser?”

A FOX News representative soon called me and said that recipients (them) aren’t subjected to tax. Their legal department said it did not think that any single video would ever have value greater than $12,000. (See update below). iMediaEthics pointed out that the issue of gift tax is the aggregate of a citizen journalist’s donations to FOX News over a single year. In response, they said they would cooperate with any IRS investigation. In other words, if you do get caught, FOX News’s hands are tied and they must answer the IRS’s questions. (No skin off their teeth – you, not they, are the ones who have to pay the gift tax. They are covered.)

After hearing from FOX, CNN’s Jennifer Martin, Director, CNN Public Relations, New Media and Digital Networks, informed me by email that, “We’re declining to comment at this time.” No word yet from Huff Post or MSNBC.

Seemingly, the easy solution to all this mess is to just pay citizen journalists for content. Unfortunately, any trend formerly going in that direction has boomeranged and has gone in reverse. Even the much touted Oh My News—one of the only citizen journalism web sites that pays contributors—just announced it will cease paying for content on February 1, 2009.

Further research is needed to develop a more efficient and less costly means for determining intellectual property’s FMV for everyday citizens. After hearing about this gift tax problem from iMediaEthics, David Ardia, speaking on behalf of Harvard’s Citizen Media Law Project, promised that “CMLP is now [going to be] looking into this issue… This is a bigger piece of the tax implications of citizen journalism. I think it is an area that needs to be examined more carefully. My expectation is we probably need to change some of the laws around this so we can foster active citizen participation in news gathering and dissemination.” Both appraisal firms iMediaEthics spoke with are interested in helping reduce the costs to citizen journalists for appraising the value of their work. Paul Engel, managing director of Appraisal Economics Inc said he believes citizen journalists need understand the value of their work. “People [media] should be paying for what they are getting. The consumers may starting looking twice now if they realize there might be gift tax and they’ll say ‘Hey, if I’m getting it [gift tax bill], clearly there’s some value here.'”

When asked about the implications of the study, if it will help move power back into the hands of citizen journalists, Ardia, Harvard’s Citizen Media Law Project, said, “It seems to me in order for that power shift to happen, there needs to be knowledge on the part of the contributor that this is what they’re facing.”

Update : 01/15/09 – As reported by Silicon Alley Insider, a citizen journalist, Janis Krums, was the first to capture and post a photo of the US Airways Flight 1549. Krums could have given the valuable images to FOX News but chose instead to make the images free to everyone via Twitter.

Update: 02/10/2009 – While Krums made the photo available worldwide by posting it on Twitter, a third-party sub-licenscing deal was apparently made with AP. Santiago Lyon, AP’s Director of Photography, told PDNPulse.com, “I can confirm we purchased the rights to the photo of the airliner in the water from Janis Krums, recognizing its newsworthiness and timeliness during an especially hectic afternoon and evening.”