(Credit: Flickr/ 401kcalculator.org)

USA Today posted one doozy of a correction for a front-page story on North Carolina’s taxes. In a May 9 print correction, USA Today corrected or clarified four issues in the story, “States may provide a window into taxes under Trump.”

The front-page article, although published by USA Today on its front page, was written and reported by the Center for Public Integrity’s Lateshia Beachum. Beachum is the Kellogg Investigative Reporting Fellow, which according to a 2014 job posting for the position, is a yearlong $35,000 gig. The tax article was the second article with her byline since November.

iMediaEthics wrote to Beachum to ask how the errors occurred and how she or the center found out about them. Her response was, “I’m not interested in discussing this.”

iMediaEthics has also written to the center to ask how the errors occurred, how the center learned of them, and if it is normal for a reporting fellow to have only two bylines in six months.

The correction was posted both on USA Today‘s website and on the Center for Public Integrity’s website. It corrected these issues:

- North Carolina expanded what can be taxed under the state sales tax

- North Carolina has a 4.75% sales tax and counties can add “another 2% or more”

- North Carolina’s top income tax rate in 2012 was 7.75%

- A clarification noting, “The story also should have made clear that some states are phasing out state income tax rates over time and the Tax Foundation’s position on North Carolina’s and Kansas’ tax reform proposals.”

The Tax Foundation’s spokesperson John Buhl told iMediaEthics by e-mail, “We had been interviewed on two occasions for the piece. When it came out, context we had provided was omitted, presumably to advance a narrative, but there were a number of factual errors as well. We compiled a list and submitted them, and USA Today worked with us and CPI to address all of the factual errors and some of the omissions.”

iMediaEthics asked Buhl what context was omitted. Buhl explained:

“Our views on Kansas’s tax cuts (which is readily available on our website) and North Carolina’s decision to repeal the earned income tax credit (though the state did raise the standard deduction to offset the impact) were not included in the original piece.”

Buhl noted the center added the following sentence after the foundation’s complaints. “The foundation says it is nonpartisan, having supported retaining the Earned Income Tax Credit in North Carolina and opposing Kansas’ tax cuts….”

Further, Buhl told iMediaEthics that the center originally didn’t state that the center’s policy analyst Jared Walczak “testified on both the pros and cons of the bill.” As such, Buhl stated the center edited the story to state “‘Walczak offered pros and cons about the West Virginia tax proposal but called it ‘groundbreaking,’ and that ‘sometimes a state needs to consider bolder moves,’ the Gazette-Mail reported.'”

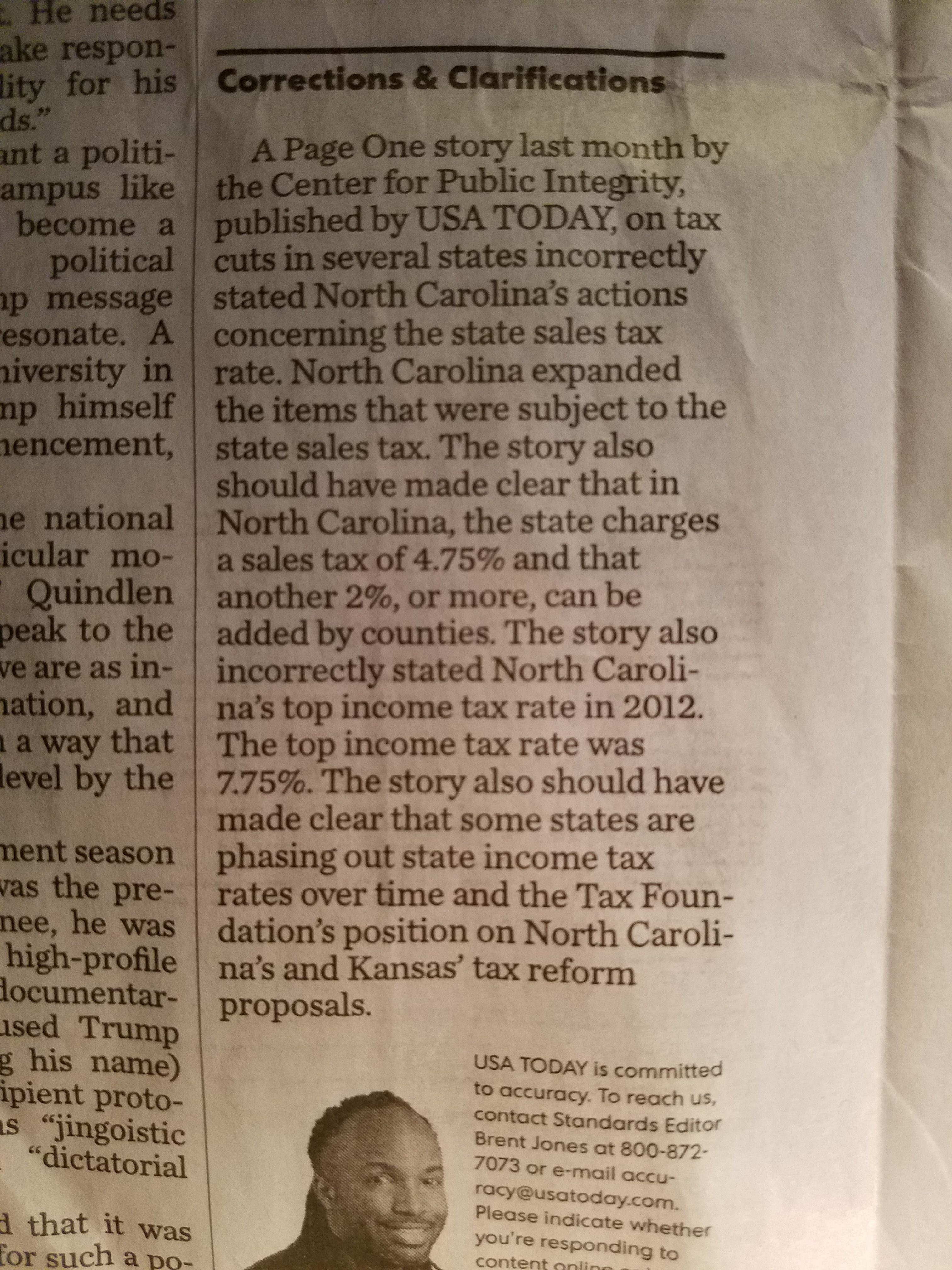

The correction was published on the article on USA Today‘s and Center for Public Integrity’s websites and also in USA Today‘s corrections and clarifications column.

The full correction reads:

“An earlier version of this story incorrectly stated North Carolina’s actions in regard to the state sales tax rate. North Carolina expanded the items that were subject to the state sales tax. The story also should have made clear that in North Carolina, the state charges a sales tax of 4.75 percent and that another 2 percent, or more, can be added by counties. The story also incorrectly stated North Carolina’s top income tax rate in 2012. The top income tax rate was 7.75 percent. The story also should have made clear that some states are phasing out state income tax rates over time. Added is a clarification on the Tax Foundation’s position on North Carolina’s and Kansas’ tax reform proposals.”

See the correction and clarification in USA Today’s print edition below.

UPDATED: 5/30/2017 10:11 AM EST To add text of correction

UPDATED: 5/30/2017 10:54 AM EST With comment from Tax Foundation

UPDATED: 5/31/2017 9:12 AM EST With more information

UPDATED: 5/31/2017 6:06 PM EST

Comments Terms and Conditions